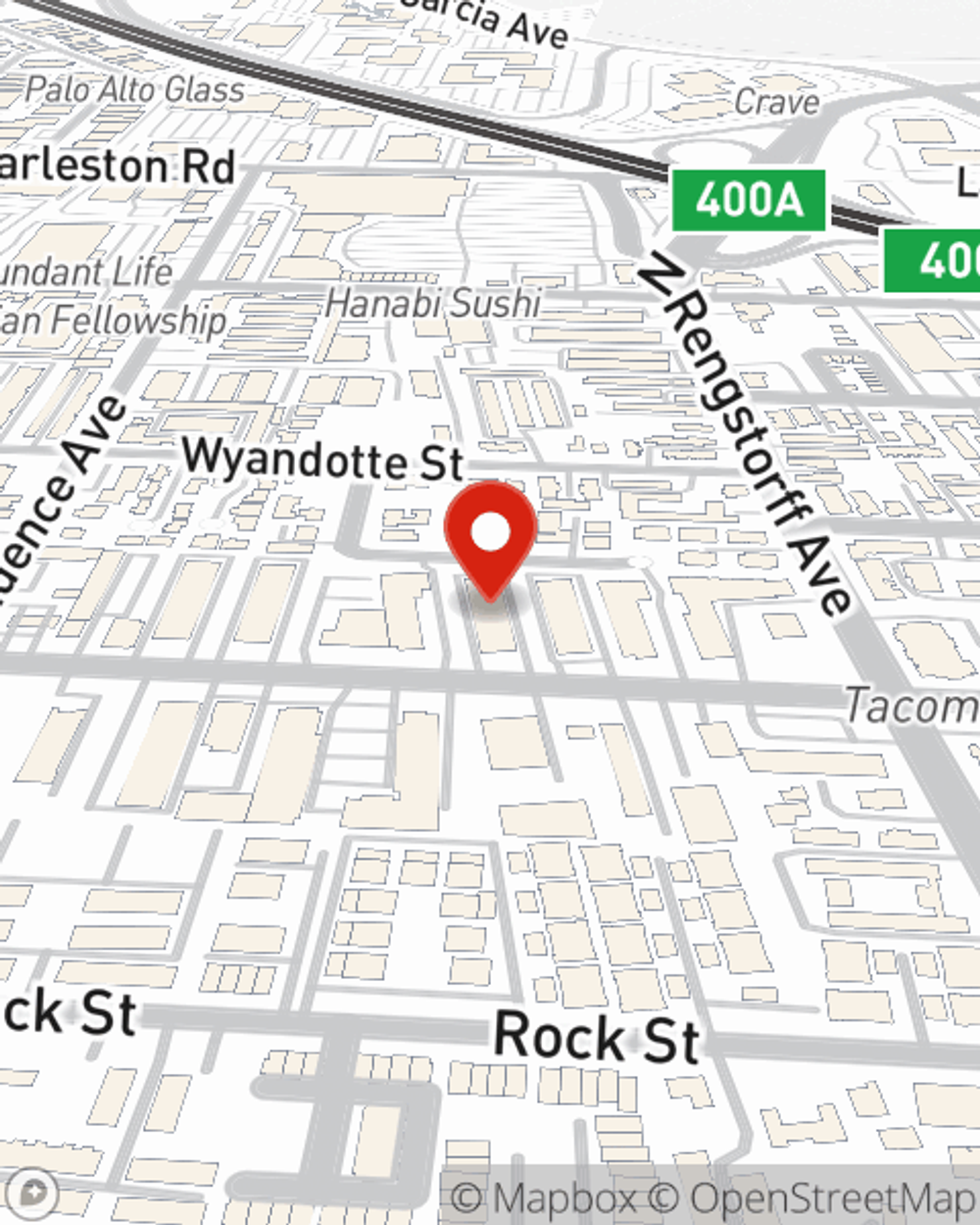

Life Insurance in and around Mountain View

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

One of the greatest ways you can protect those closest to you is by taking the steps to be prepared. As uneasy as thinking about this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Life Insurance Options To Fit Your Needs

Having the right life insurance coverage can help loss be a bit less complicated for the people you're closest to and give time to recover. It can also help cover bills and other expenses like rent payments, retirement contributions and future savings.

Don’t let worries about your future make you unsettled. Reach out to State Farm Agent Curtis Cahill today and see the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call Curtis at (650) 961-6700 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Curtis Cahill

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.